I Dont Want to Spend Money on Appraisal if My Art Is Worthless

Gordon Parks, Untitled Fashion Photograph, c. 1960s

Twenty-four hour period 14 Today is Mon, January 16,th and we are studying the twenty-first century phenomenon of art investment funds.

Our particular case study is the Tosca Photography Fund, for which yous have the 2010 almanac report. But also check out

the chapter from Horowitz on Art Investment Funds (and the accompanying appendix). In your response to the reading,

imagine/design your own art investment fund with sample piece of work (due south) and strategies.

Readings

Art of the Deal: Affiliate iii

ARTH 4696 FINLEY Fine art Investment Funds HOROWITZ.pdf

Fine art of the Deal: Appendix C

ARTH 4696 FINLEY Appendix C Art Investment Fund Universe HOROWITZ.pdf

Tosca Photography Fund Year Finish Report

Tosca Photography 2011 fund review.pdf

Individual Contributions

Charles Saunders

The fine art market place is on a very interesting trend. From a relatively esoteric get-go in which transactions were relationship based between few, established buyers and sellers, the globalization of the art world has produced a more structure marketplace with greater transparency, liquidity, and visibility in the eyes of the investing public. Art funds, in theory, are in a unique position to profit from the appreciation of art and the current bull market, as they possess several singled-out advantages to dealers: they are capable of lower costs and overhead, equally they don't require large exhibition spaces, they can employ a broad selection of expertise (unlike dealers who oft specialize), the big capital bases provide unprecedented purchasing ability, and longer, buy and hold investment horizons are possibly the ideal way to invest in art. Fine art is very unique, in that it a superior skilful (significant as wealth increases, need for the product increases) yet information technology is highly uncorrelated with other popular investment vehicles. The fluctuations of the stock market has little connexion wit hthe art marketplace, and demand has often been sustained in times of economic recessions. The primary factor behind this sustained bull market place is the prestige element in fine art investing, in that fine art carries a meaning value in its signaling of wealth and status, factors that don't disappear with the economy. The wealthiest portion of the consumer base will always accept a very strong desire to point their condition, and won't be as susceptible to marketplace volatility, creating a very stable and sustained demand base. As a result, many high-profile, high-toll transactions have produced widespread public interest in the art marketplace -- while these sales may non be indicative of the larger market place, their volatility creates consumer confidence and involvement, which is ultimately the largest and nigh meaning driver of value in an industry in which the product -- fine art -- produces no bodily cash flows to its owner. Many of the costs are sunk, and lie in transaction, storage, shipping, and insurance expenses -- these expenses are no dubiousness inflated, as there are many inefficiencies in the relatively young art investment market, such as conflicts of interests in transactions and large information asymmetries. Moreover, the only real opportunity to realize an investment lies in its resale. While the resale value is a relatively riskless investment, frequently the investment horizons required to fully ensure this value are much longer than time periods investors are comfortable with, specially every bit holding art during the time period can be cash flow negative. Prices are opaque, difficult to predict and quantify, and subject area to buyer'south preferences, which further makes resale value difficult to ensure. The combination of these factors represent pregnant obstacles for an investment fund full-bodied on art. I can infer that art, equally role of a diversified portfolio of assets, works best when it is used as a hedge confronting other facets such equally debt or equity, due to its depression correlation with these investment vehicles and its ability to weather bearish markets. What seems fascinating is that most investment theses concern products that comport inherent monetary value, accept easily agreed upon valuations due to concrete monetary cash flows and discounted cash period analyses, and are traded in a marketplace with sufficient liquidity to ensure resale and consumer conviction. Not only does art fail to satisfy these requirements, just its very value depends in its uniqueness and scarcity. If art funds and investment strategies succeed in becoming mainstream and ubiquitous, the event will be the commercialization of art, the mass increment in its production to run across the rise in demand, and its eventual homogeneity equally arbitrage and mass scrutiny eliminate inefficiences and equalize differences in value. This very process of commercialization volition ultimately destroy the scarcity and uniqueness of art, and thus its value; equally fine art funds experience success, they will proliferate, and fine art volition become homogeneous, and thus diminish in value as a signal of prestige and an artful decorative slice, and thus the very investment funds which seek to profit off fine art's value will ultimately destroy information technology. In short, the procedure of the commercialization of the fine art market can ultimately lead to its demise -- art cannot function as a consumer production, equally information technology provides no greenbacks flow and has no truly functional value. For it to keep is success, it must maintain lower levels of supply and scarcity, which volition be hard to ensure every bit its popularity as an investment grows.

I don't recollect I would create a purely fine art-focused investment fund. I think there are inefficiencies to be exploited in art, but the time horizons required to fully maximize returns are prohibitive. Even in the past, when art funds have taken fully reward of bull markets, their inflation-adjusted annualized returns and IRR'south accept been marginal, and may non first opportunity costs. Information technology is difficult to fully approximate marketplace trends, and opportunity-based strategies would exist subject to higher volatility. Middlemen such every bit sale houses have large cuts of returns, and there are many instances of conflicts of interest in the marketplace prohibiting a fully competitive or efficient market. Art in and of itself provides no cash flows to buffer market place downturns, and sunk costs are considerable and unavoidable. Some firms accept opted to vertically integrate, identifying expert artists at young, cheap stages in their careers in the hopes of value appreciation, or investing in one medium in one geographic setting at all stages of product, only even this strategy poses fundamental bug, as art ultimately acquires value through its increment in public perception, eye-catching sales prices, and inclusion in art magazines and critical analyses -- a purchase and concur strategy effectively takes art off the market, and thus prohibits it from acquiring reputation and marketing capital through public acknowledgement. Furthermore, whatever success is likely to produce many copycat funds and entrants to the market place, which will further reduce returns. If I had to include art as an investment -- I practice retrieve it is valuable, as there are inefficiencies to exploit, strong recent up market place trends, and negative correlations leading to high hedge value in portfolios -- information technology will be as a part of the diversification process in a larger fund that includes equity, fixed-income investments, and other investment vehicles.

Christina Chaplin

Throughout history, there have been numerous attempts by the fiscal sector to make coin from the successful appreciation of art investments. However, as the readings seem to bespeak, this is a very risky concern which has non seen much success. Despite this, fine art investment funds have recently seen a revival of sorts in the 21st century. The art market is turning towards commodification as it never has before, and many investors see this as an opportunity to make it early on and earn high levels of profit by strategic buying and selling plans. Unfortunately, this do has really non get much less risky every bit one can come across in the large number of abased funds in the early on 2000s. The problem with the market's stability is partially due to the inefficiencies of the market and also the distinctly unlike way that fine art is valued every bit compared to many other categories of assets. Fine art can be catchy to value because it is worth what someone is willing to pay for information technology at the fourth dimension. Its price is too not an isle unto itself. The price of an art work can shift dramatically due to several factors including the selling toll of other works by the same artist, the creative person'due south connected or discontinued ability to produce new works, the historical significance of the slice, the reputation of the galleries or dealers that take a share in the creative person (as representatives or holders of other works), the piece'southward individual history, and full general media hype about the artist him/herself. Therefore accurately predicting the value of a piece of work can exist difficult. Some meet these fluid market changes every bit an opportunity to manipulate the market, but given the circuitous nature of the fine art market and its delicate infrastructure of ego and speculation, this opportunity can before long get treacherous. Further, there are many who believe that the practice itself of turning work into a commodity can strip the work of all symbolic and cultural value, which can significantly change its desirability on the market. Even if a piece of work is "worth a lot", it is actually worth nothing if no ane else is willing to buy it from you.

In reality, after seeing the statistics on the failure of art funds, I might non see this as plenty of a feasible option for making money and would forego the opportunity entirely. However, if I did decide that I wanted to endeavor my manus at a market were others had been unsuccessful, it would have to exist carefully plotted and full of fallbacks in the case of market failure. Like a adept portfolio, I remember it would be important that the fund be diversified. All though this might limit the overall profit of one sector which is highly successful, it would too mitigate losses if the other terminate of the spectrum should ascend. To diversify the portfolio it would be important to have several different genres of work, work from a range of fourth dimension periods, and artists of varying levels of fame and repute. The fine art would be collected as follows:

xv% onetime masters and Renaissance/Baroque period work (l% painting, 20% drawing, thirty% sculpture/structure)

25% gimmicky art (xl% painting, 20% sculpture, xxx% impress, photography, new media, 10% film)

30% impressionist/ modernism

15% antiquities

xv% quondam masters (non-western/Asian, Indian, Middle Eastern, African regions)

My fund's strategy would have to employ an array of marketing, advertizement, and commercial activities to ensure the longstanding value of the work held. Work held in the fund would exist loaned for a percentage of its purchased value to members of the fund for no longer than 1 year with insurance, loaned to major museums and institutions with solid reputations, loaned to galleries for temporary exhibition, or loaned to collectors with reputable collections. Selected works would be put on exhibition, specifically curated to highlight the cultural value of the work held by the fund, which would exist open to public viewing, media coverage, entrance fees. Media coverage of artists represented by the fund would be highly encouraged, and the fund might fifty-fifty publish its own books or informational publications to inspire religion in the stability of the fund and its artists.

The work in the fund would be acquired from "distressed" sales of work beingness sold at low prices by collectors, galleries, or even museums in demand of uppercase. It will exist held by the fund for no less than ten years, at the end of which time all work will exist sold from the fund in a series of v auctions, each roofing a detail category of art held. These auctions will be highly publicized earlier the event, and will be by invitation only to increase exclusivity and potential toll ranges of work past competition and feelings of "now or never". Investors in the fund would be able to invest a minimum of 10,000 dollars, with hopes of x-fifteen% returns.

Some art the fund would hope to larn would include:

http://images.arcadja.com/donatello_donato_di_niccolo-s___an_important_italian_terracotta_r~300~10000_20060126_N08162_74.jpg

Donatello

http://karlzipser.com/mich1jpg/haman2.jpg

Michelangelo

http://jameswagner.com/mt_archives/Chris_Martin_Glitter_Painting.jpg

Christopher Martin

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEizzZ5ki_d9s5qdPbzSaO2hyphenhyphenevyDMYSDFfouuPtk5FTIuAN2dwPjS0aL0R5IVsZXJBZcVbu6dXVmdal11FIaEwa-38SJlj0pQda3OHK5D5mu3f1Fvpd4WBE1hzZAG-dDISRgk-L00ZfBfkH/s320/picasso33.JPG

Pablo Picasso

http://www.artinamericamagazine.com/files/2009/10/26/img-kraus-1_173038618769.jpg_standalone.jpg http://world wide web.artinamericamagazine.com/files/2009/x/26/img-kraus-1_173038618769.jpg_standalone.jpg

Kitty Kraus

http://theartblog.org/weblog/wp-content/uploaded/nickcave-300x225.jpg

Nick Cave

Dalanda Jalloh

Investing art is a practice that is poorly understood largely due to its controversial nature3. Art investment is looked upon as a mechanism that strips art of its cultural and creative meaning and transforms fine art into a purely money making strategy. It was interesting to learn about the development and occurrence of different art investment funds and strategies and run across the different factors that were considered during the development of certain investment plans. During certain time periods, in that location were unique threats to the success of some art investment funds and it was very interesting to see how sure investment managers and investment strategies were created to counteract possible failure of their investment portfolio.

If I were to create my own investment fund, I would employ a variety of strategies and utilise multiple investment vehicles2. I would use a "showcasing" strategy, which would seek to increase the funds in my fine art investment portfolio by placing my works in important museum shows2. The exposure of the art tin help to attract more than money to my fund. In addition to that method I would use a "distressed art" strategy in which I would learn fine art at pregnant discounts from collectors who are selling due to the likelihood of bankruptcy or insolvency2. I would also attempt to brand sure that inside my collection of fine older art, I would include new artists as well. In doing and so I would adopt the "emerging artists" strategy and heart my investments on new artists in the fine art earth who are not yet established and therefore have the potential for rapid toll appreciation. Because art investments are typically long term, I would possibly try the "buy and concur" strategy and agree on to artworks hoping that with time and a consistently good market, I can earn some return. If this strategy becomes unsuccessful within a few years, I may forgo it and adopt another ane. The same goes for if any of the other strategies mentioned fails quickly. Using these four strategies would hopefully garner some success and money within my investment portfolio. Also, I would take a US based investment vehicle and one located abroad (likely in the British Virgin Islands because it's a common offshore fund region and investor-friendly region2, 3). This would let me to take in monies from both domestic and foreign sources. My art investment fund, like most others today, would likely resemble a private equity fund or hedge fund in terms of its structure and operation.

If feasible, the artwork collection in my investment portfolio would consist works from classic artists like Pablo Picasso, Henri Matisse, Salvador Dalí, and Rafael. In terms of contemporary art, I would look to include artworks from Damien Hirst, Jeff Koons, Horace Pippin, and Henry Ossawa Tanner, for their thought provoking pieces. Emerging artists like William Wray and Caroline Marine, would inspire how I approach and include emerging artists in my pieces. My collection would consist of paintings mostly, but at that place would exist sculptures, photography, and other forms of fine art from these artists and those similar to them. I would definitely want attending to my pieces, to garner more funds on investments.

Sample Painting by Caroline Marine:

Sample Painting by William Wray:

References:

iihttp://world wide web.artfundassociation.com/_what_are_art_funds/basic_af.html

http://www.artfundassociation.com/_what_are_art_funds/basic_af.html3Horowitz, Noah. Art of the Deal: Contemporary Fine art in a Global Fiscal Market. Princeton, NJ: Princeton UP, 2011. Print.

Daniel Chazen

The interesting thing most art funds is that their focus is nigh all almost fine art as a ways of making coin. Unless, for instance, an art fund publicly displays its holdings or allows investors to temporarily borrow a work, the art fund basically treats fine art every bit zippo but an "asset" which will hopefully turn a profit. In other words, the goal of the fund is to achieve significant financial benefits to investors (Horowitz, 156-57). But what I find most interesting about an art investment fund is how the fund'southward holdings are valued. When it comes to a publicly traded stock or a mutual fund, there is an open and transparent means for buying and selling which sets the market place price. Simply that is not exactly the case with art investment funds.

For some fine art funds, such as artfonds-21.com, referenced by Horowitz in Appendix C, the goal is a publicly traded stock corporation that volition provide a measure out of value in the market identify for its holdings.

Without some sort of publicly traded equity in the investment fund, the investor in an art fund must rely on practiced valuations, such as the detailed appraisal Professor Finley provided the Tosca Fund in 2011.

What I plant very interesting well-nigh the Professor's appraisement is that in valuing a fund, one has to rely on a lot more than than auction prices. I had originally idea Thornton'southward assessment that art is worth what "someone is willing to pay for it" as an easy estimate of value. But it's overly simplistic; many more than factors are in play and need to be considered, e.yard., uniqueness and history of the work, given the reality that non every piece is readily auctioned or sold.

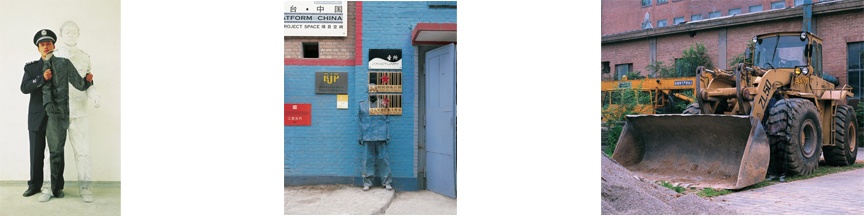

Interestingly, the increasing popularity of art investment funds is in and of itself a approximate of the stabilization fine art values since the outset of the recession (as well as a reflection of renewed confidence in the funds subsequently many of them closed down ). 1 recent fund, known as the Art Substitution, was started last year. In its brochure, which refers to the company as "The Stock Exchange for Art," it lists its attributes as:

Hither is the link to their brochure: http://www.afmarkets.net/en/brochure.pdf

With the fine art market place, in that location has always been an effect of business concern with transparency. In social club to address that business when it comes to fine art funds, the Art Fund Association was started in club to brainwash the public as to all aspects of the art market. http://www.artfundassociation.com/

Given that the Association needs the funds to survive, I wonder whose interest it considers more important – the investors or that of the funds?

Investing in an art fund has come a long way since the model of the British Rail Pension. While the funds had some smashing success, at that place has also been multiple cases of funds endmost down. It tin't be like shooting fish in a barrel to constitute a profitable art fund. If I were to effort to blueprint an fine art investment fund, I would starting time focus on establishing a fund that acquires artwork which is part of a small niche, which, while non very diversified, would brand it more hands to market to potential investors. What comes to listen is some aspect of the contemporary art market, allow's say, the works of gimmicky artists live in New York Country. I'd call it the Empire State Art Fund. I would attempt and condition management fees, appraisal fees, and investor return on the existence actual profits from sales. In other words, aside from essential operating costs, no one involved in the fund makes whatsoever coin until in that location is an actual and realized profit. At that point, at that place would have to be an equitable distribution of a portion of the profits .

The highlights of the fund would be something like this:

THE EMPIRE Country ART FUND

- Just acquiring contemporary works (of all kinds – paintings, sculptures, etc. ) from artists based in N.Y. State. (Seeking to establish a following and loyalty amongst NY artists and NY art investors).

- No acquisitions in excess of $10,000. (Creating the possibility for a large return on investment and establishing interest by focusing on works that are not yet well known).

- Maintain, as noted in Dr. Finley'south Toscafund Report, a "thoughtful and strategic acquisition policy."

- Minimum investment of $1,000 – airtight end and private - amount invested determines amount of equity in the fund (making it easy for many to participate and invest in the fund).

- Whatsoever works can be borrowed from the fund for a short period of fourth dimension (as long as insurance is in place).

- No returns (for advisors, direction or investors) until the fund makes an actual profit (establishing integrity).

- Any sales to be conducted on line at the fund's ain web site. (no sale commissions).

- Monthly statements of all action (complete transparency).

- All finances to exist handled by a public accounting firm.(Create integrity and so investors accept trust)

Example acquisitions:

ane) Christa Toole

Oil on Sheet

"Gravitational Wave"

Acquisition Toll $1500

2) Soos Packard

Sculpture

"chickn lickn head"

Conquering Price $2500

3) Kelso Jacks

Painting

"Prey"

Acquisition cost: $750

Elena Cestero

From the reading it seems that Art Investment Funds are definitely a risky way to invest. The funds take rarely been successful with the exception of the British Track Alimony Fund created in the 1970'south which actually was non even as successful every bit it appeared. While in theory investing in fine art may seem like a sure way to brand money, the uncertain and volatile nature of art value has shown it to be much less straightforward. The connected interest in this type of investment is curious given its history of failure.

I detect the idea of Art Investment Funds disturbing in its lack of regard for art's intrinsic value. Even more than than anything we have seen thus far, the Art Investment Fund is concerned with nothing more than fine art's monetary value. The comparison between real manor and art investment was also concerning. How can nosotros guarantee that a bubble is not being created that will eventually pop? I likewise noticed that some of the funds allow their members to display the fine art from the funds in their homes. This seems similar another significant risk, what if a slice is non cared for properly or accidentally destroyed? What if a fellow member has a piece of art and the fund fails, does the member get to keep the fine art? What if they refuse to render it in order to regain at to the lowest degree some of what they invested? While I'thou sure that the works are insured and the members accept signed contracts that stipulate how everything will function, it still seems like at that place is a high potential for problems.

While the Tosca Photography Fund seems to be functioning acceptably, I certainly would not invest my money in an Art Investment Fund unless more show of stability could be presented. Speaking hypothetically, if I did invest, I might do the following:

1- Buy lesser known works by established not-living artists.

2- Buy works from contemporary artists on the verge of success, before the cost for their work become excessive.

three- Make sure to mix the type of fine art to include paintings, photos, and sculptures in an try to diversify the portfolio and hopefully meliorate the chance of returns.

four- Limit the number of investors in an attempt to maximize individual returns.

five- Hold the works until their value appreciates considerably.

Here are a couple examples of the kind of works that I would try to acquire for the fund:

A piece of work by an established not-living artist:

Diego Rivera's "Mujer Bañandose" which recently sold for $116,500 at Sotheby's simply I think has the potential for a higher value in the futurity.

A piece of work past an emerging creative person:

Adam Pendleton's "Arrangement of Display, E (ETERNAL/Confronting/Jean-Luc Godard, Le G Escroc, episode from Les Plus Belles Escroqueries du Monde, 1964)" which was displayed at Fine art Basel 42 in the Art Statements section.

June Shin

While most dealers, galleries, and collectors want to altitude themselves from the commercial side of art and requite genuine, pure honey for art as their reason for selling, buying, and collecting of art, art funds operators or managers exhibit an openly money-oriented attitude toward art. After all, their goal is to maximize the rate of financial return on artworks in their collection.

An manufacture still at its developing stage, art investing has several advantages. Art funds are more immune to external factors like economic crises. Because fine art funds buy and hold on to the artworks, they are less susceptible to fluctuations in the market (Horowitz 148). Even during inflationary times, a piece of work of art will yet exist worth something, whereas company shares oftentimes get worthless (Horowitz 148). Likewise, since the art market is "fragmented and hybrid," a turn down in price of works in one sector does non mean the same for another sector (Horowitz 148).

In Tosca Photography Fund'south twelvemonth end report by Professor Finley, it is revealed that many factors bear on the valuation of artworks, among which are rarity, historical and intellectual weight, uniqueness, field of study matter, provenance, exhibition history, press dates, and medium (Finley four,5). For photography in detail, printing in editions lead to the decrease in value (Finley 4). Ofttimes times, the prices of works by other comparable artists are helpful in determining the value of an artist's work (Finley v).

If I were to found an art fund, the basic blueprint would be as follows:

i. Target for an annual return of ten-15%.

2. Diversify: Buy fine art in 4 different categories: 1) Old Masters, 2) Impressionist art, iii) Modernistic art, 4) Contemporary art.

iii. Set the minimum contribution at $250,000.

four. two% will be taken off for overhead and operational costs and20% for performance fee on earnings.

5. Accept a lock-up menstruation of 10 years.

6. Profits will start be distributed after the tertiary year.

vii. Lend fine art pieces to museums or important exhibitions to reducing storage and insurance costs add provenance and boost resale price (Horowitz 150). Lending works to exhibitions will as well increase publicity. When prestigious magazines and newspapers write reviews on the works, their value accrues (Finley16).

8. Provide investors with yearly argument of professional appraisal of the fine art in their portfolios for confidence and integrity.

In such industry as art investing in which decisions are largely dependent upon the grade of the marketplace and auction, market assay will exist key to obtaining success when it comes to re-selling. Respected art appraisers and advisers will be of critical importance.

Moreover, apart from the most central guidelines laid downwards equally higher up, the Tosca Photography Fund seems to take benefitted from carrying out retrospective exhibitions and private events too as publications. Exhibitions and private events will help foster solidarity among investors, and publications will increase the chance of sale of the works included in the book. Negotiating with auction houses to drive the commissions downwardly can besides help in securing more profit and incurring less cost.

Sample works I would buy:

Gustave Caillebotte. The Man on the Balustrade.

https://encrypted-tbn0.google.com/images?q=tbn:ANd9GcTkOhHlX0Xa98NeJCE_LzpKOOvy46KR0Kn7pHG9YArKxWNJs7vR

Geraldine Gliubislavich. Untitled. 2009.http://www.vegasgallery.co.u.k./wp-content/uploads/2010/09/untitled-42.jpg

Kelly Zona

Name of Fund: Art Pol

Fund Overview: Contemporary Photography and New Media Fine art (both with a focus on gimmicky political issues)

Investment Details: Target- $100 m ($75 g institutions), Term: ten years

Fund Description: Target Returns o f xxx-40%

This investment fund will use a diversified strategy and focuses on two market sectors: contemporary photography and emerging new media art. A focus on political problems is the underlying characteristic that volition necktie the two sectors together. This focus intends to add insurance to the value of the works through their cultural and historical significance.

The optimal allocations for each sector are: photography- 70% and emerging new media art- 30%. This construction of allocations is meant to employ contemporary photography as a base, as the photography market has washed especially well in recent years and is expected to continue to do and then, based on Tosca Photography Fund's 2011 Analysis [four]. New media art acquisitions will be of higher gamble, simply with the expertise of the advising board, these investments are expected to generate proportionally college payoffs.

This summary projects that investments will be fabricated until yr four, and divestments will be made from years three to ten. These fund will target about $75m or 75% in institutional investments, creating complex financial ties non possible solely with individual investors. For fiscal security, any purchase greater than 10% of the funds commitments will exist subject to approval by the Fund Lath. The fund will be registered in the British Virgin Islands to avoid capital gains taxes. The difference saved volition be reinvested toward time to come purchases.

An additional financial strategy will exist to loan the works out on exhibition. By placing works with prominent art institutions, the works volition larn another layer of history and cultural value. This strategy is intended to assist boost resale prices.

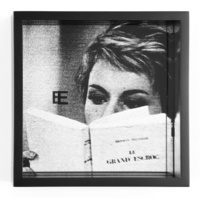

Hiding in the City, by contemporary Chinese artist, Liu Bolin, is an example of the fund'due south photography investments. For this series, Bolin takes photographs of himself camouflaged to blend in with urban landscapes.

[1]

He intends for his works to bear witness the furnishings of the city on the people living in them. The works take a potent political calendar. He states, "I experienced the dark side of guild, without social relations, and had a feeling that no one cared about me. I felt myself unnecessary in this earth. From that time, my mental attitude turned from dependence into revolting against the organisation." [2]. He likewise uses his work to protestation against artistic persecution. He continues, "...contemporary art was in quick development in Beijing, but the authorities decided it did not want artists like us to gather and live together. As well many exhibitions were forced to shut." [two].

Mona Lisa Meta-data is an example of the new media fine art that the fund would focus on. The slice was shown at the Second Annual International Art and Science Exhibition and Symposium in Beijing. Users tin can change the iconic prototype by using newly developed optical tracking engineering science, in which that stated purpose is to "offer one possibility for an even more than transparent interface" [3]. But the piece of work also brings into focus larger political issues, such as the authority of the West and globalization [3].

[three]

Thus, it is works like these that the fund will focus on due to the added value of their social and historical commentaries. While the new media art category is less divers and more than volatile, the Fine art Politico Fund will attempt to capitalize off its emergent status, as some other chapter in the history of artistic evolution.

Sources:

[1] http://v1kram.posterous.com/liu-bolinthe-invisible-man

[2] http://www.dailymail.co.u.k./news/article-1201398/Liu-Bolin-The-Chinese-artist-turns-Invisible-Homo.html

[3] http://magazine.fine art-signal.com/en/one-cache-memory-of-new-media-in-china/

[4] Tosca Photography 2011 fund review.pdf\

[5] ARTH 4696 FINLEY Fine art Investment Funds HOROWITZ.pdf\

[vi] Tosca Photography 2011 fund review.pdf\

Khrystyne Wilson

Fine art funds are a very interesting concept considering they are solely interested in the budgetary value of the art, thereby they turn a profit from the sales of art, but not in the same manner that a dealer does. Art Funds crave less infinite to testify their pieces of fine art, and have lower costs overall than dealers do. At the same time, Fine art Funds are entirely dependent on a successful sale of their piece, which may fluctuate based on economical problems in social club. All the same this is not as large of an consequence, as this is buffeted by the social value of fine art. Fine art demonstrates an elevated condition in club, and thus the wealthiest people in society are the ones shelling out millions of dollars to these Art Funds, and these people rarely are that affected by economic change, and thus will continue to purchase fine art that elevates their social and economic status.

Nevertheless, Art Funds are field of study to volatile sales, as determined by the need for a certain piece. The coin an Art Fund makes, is fabricated through resale of a piece of art. Thus, people who manage Fine art Funds must determine that something is worth more money than information technology is existence sold for, buy it, and resell it at a greater price. This is ever a gamble. 1 could overestimate the demand for a certain slice, due to either the market already having too many similar pieces, or general indifference to a piece. Thus, in this state of affairs, the best matter to practice is to hold on to the piece until demand is increased, however this means no coin coming in, and negative cash flow. I believe that Fine art Funds may decrease the Art Market, because of its solely budgetary based nature. This is making it into a consumerist, industrialized market, where at that place is no appreciation for uniqueness or outlandish art, but just for that which will sell. Too, information technology puts also much control in the hands of the people who run the Art Funds, considering as they have to power to hold onto pieces until they will be worth more, they will be able to completely control the art marketplace, dictating what is pop at the fourth dimension.

However, if I were to create my own investment fund, I think the most of import affair I could do would exist diversify. Past limiting myself to a certain area of art, I could be harming my business organization because it is always uncertain when a certain blazon of fine art will go obsolete. By having a diverse portfolio of paintings, photography, sculptures etc. etc. I believe I would take the best adventure of success. Also, I would utilize the same methods that the Tosca Photography Fund employs in advertising. By garnering printing interest in my pieces, I would be more than likely to sell them. I also would place some of my pieces in museums or galleries to increase the hazard that they will sell by providing a place where they will exist exposed to potential buyers. For my art fund, I also would diversify the artists, and their level within the art market. I would buy pieces from already known artists, to demonstrate my noesis of the art world, and besides buy pieces from lesser known artists that are similar to the successful artists I already own pieces from. The pieces from artists who are already successful may non sell for much more money than I paid, however information technology would be a skillful style to bring in art enthusiasts, and then innovate them to new artists who accept not been exposed withal. It is through the new artists that I will exist able to make the bulk of my money. I would focus my efforts on whatsoever fine art style was nigh successful, and new at the time. For example, right now I would focus my art fund on pieces that are contemporary, because it is at the forefront of the art globe correct at present, and thus would be easy to detect new artists such as Jessica Jackson and Anna Meenaghan.

Pieces by Anna Meenaghan:

Pieces by Jessica Jackson:

Kwame Nana-Atoo

Art funds are investment vehicles that, similar hedge funds and private equity funds, exist to provide substantial commercial rewards to those who provide the capital that allows acquisition of the art and to those who manage the fund. In practice most managers draw on a range of advisers and specialist service providers. The interests of those three entities are not necessarily identical. Although art funds bargain with objects that may exist described in many ways, it mostly stand for unique aspect of a nation or region'south cultural patrimony and may be as considered priceless to those fund them. They aim to maximize the charge per unit of render on works in their collection. Sale of works acquired by a fund may occur progressively throughout the life of a fund - with returns being useful in buy of works that will provide greater returns in future and in securing participation by additional investors. In the reading what I came to sympathise was that although the market value of particular art work may increase, the market value of other assets volition oftentimes increase at a greater charge per unit in the long term; for case buying a Picasso or Leger oil in the 1950s would produce a respectable profit when that painting was sold xxx or 50 years later.

If I were to establish an art fund showtime I will develop some strategic plans. Firstly, I will develop a plan to merchandise recognized major works, for example paintings from masters such as Pablo Picasso which are recognized to have meaning oeuvre and therefore are very likely to appreciate in value faster. In doing this I will have to carefully analyze the market, as there seem to exist an uncertain ascent and fall in prices of some famous well-known artist. Then I am not going to get works just because the creative person in famous, but because of the quality and nature of the works of the artist. The second strategy I will take will exist to acquire, concord and then sell works that are more clearly undervalued. These volition be works by artists who are recognized equally important but not on the level of existence classified as kickoff rank-information technology will also include artist who are yet to jump from commercial galleries to more acclaimed national collections and genres. It may seem as a risky strategy, because information technology is depending on the hope that in some years to come up it will sell at higher price, all the same, it is likely to be more than profitable than buying a recognized masterwork and trusting that demand for that work will inevitably push button up its value.

In making a design for my fund, I will

- Spend time on choosing the works that volition do good the fund and in turn bring in some profit and acquirement for the company.

- I will very much consider the upshot of globalization and diversity, and accept on some very interesting pieces from different part of the world, like china, middle e parts of Africa and constantly exhibit them in galleries and museum so that they tend to become very frequent images in the eyes of collectors, critics, and the full general public. That style they will reach some positive notoriety and may only brainstorm its way to be a loftier value art

- I will invest in dissimilar mediums of art, painting, sculpture, drawings, installation, music, dance choreography etc. this is because I want to embrace the wholeness of art and effect that tin emerge if the are placed side by side

- As I take a expect at where the world is going to, I will be very much un-reluctant to acquiring works, which are deeply immersed in new media technology, yet have strong roots and connection to traditional art forms. In a world that is constantly moving toward a more technological and digital age, I believe that in due that these will become very much appreciated and will fetch some good income and profits.

- My priority in this fund is to make sure that art is being appreciated for its content and pregnant, therefore, My expectancy for profits and sale and monetary input will exist at a high of $25 million for the outset five years.

- Finally, I volition take on young artist with keen potential for their artistic career, and put them in shows for proper exposure.

My hope is that the arrangement I take proposed will span through the timeline of art and its importance to aid bring a better significant to what art investment funds are all about.

This is an example of works that the fund will invest in. the names of the artist are below:

- Pablo Picasso

- Yue Minjun

- James Turrell

- Alexa Meade

- Ato Delaquis

- Rembrandt

Lipei Yu

Unable to render {include} The included page could not be establish.

McKenzie Sullivan

The success of an Art Funds is admittedly dependent on the resale value of the artwork. Thus, the management of an Art Fund must see a "bargain" pregnant the work is being sold for less than it'south worth or that it could increase in value over time. Possible problems in accumulating art could be overestimation in an artworks value or lack of demand or entreatment for the artwork. Thus, it is of import for the fund to consider holding onto the piece until the demand increases. Because Fine art Funds turn the art market into an industrialized market, at that place is lilliputian to no appreciation for uniqueness or outlandish art, just merely for art that will have commercial success. In my fund I would accumulate art that would accept commercial success but I would also invest in more than obscure art that would not necessarily accept a wide entreatment but would be appreciated past more daring buyers.

Every bit prices are generally hard to predict and are subject to buyer's preferences, this makes resale value difficult to ensure. Therefore it is important to invest in upward and coming artists where the seller is able to proper name a price without being subject to the comparison of other works that have been sold. I would consider that the value of fine art depends on its uniqueness and scarcity. In guild to create a stable, feasible and successful art investment portfolio I would consider the post-obit strategies:

- Accumulatingdiversity in mediums, genre and notoriety of the artists. If my fund were to focus exclusively on gimmicky art or former masters I would be limiting the drove's worth.

- Past creative a diverse collection of artwork including art from many movements, I could maximize the value of the collection by appealing to many unlike audiences and beingness involved in many areas of the art market.

- Diversity in notoriety of artists is also important in establishing a successful art fund. Information technology is important to have very famous and well known works but as well of import for the fund to invest in upward and coming artists.

- In particular I would invest in old masters that are adequately express in quantity and can no longer exist produced. Specifically, I would invest in Rembrandt'south piece of work because he is an extremely vivid artist who has worldwide appeal. In addition to his global recognition I believe Rembrandt'due south work volition increment in value over the side by side couple years as enormous amounts of money are being spent towards attributing and de-attributing his paintings. In detail, new technology has allowed the University of Amsterdam and the Rembrandt Research Projection to re-attribute paintings that were previously thought to be paintings done past Rembrandt'due south pupils. In addition, the Rembrandt Research projection has de-attributed paintings hanging in both the Hermitage Museum in St. petersburg and the Metropolitan Museum of Art in New which are now beingness called "School of Rembrandt." In one item case a private investor purchased a painting called Former Man with A Beard for $twoscore,000 in 1998 which was sold as a work done past ane of Rembrandt'southward pupils. The Rembrandt was afterward re-attributed thanks to x-ray technology and a particle-accelerator as ii paintings were found underneath. This painting is now worth $13 million US dollars in 2011.

- I would steer away from investing in Koons & Hirst equally I think the appeal of their work is a fad and I believe the mass product of their artwork and prints volition cause them to cheapen over fourth dimension.

- I volition consider that contemporary art is at the forefront of the art market place today and it is of import to invest in what the public is interested in.

- I would invest in up and coming artists such as Jasmina Danowski whose paintings are very colourful and abstruse. She is also a good candidate for investment every bit she uses both water-colour and oil. Artists that use unlike mediums are crucial every bit certain buyers may adopt one medium or some other. Again, when searching for an up and coming artist information technology is of import to consider how commercially successful the artists will exist. I would cull Danowski every bit I believe she appeals to a wide audience and thus will have a huge resale value. It is of import to invest in very "safe" artists that appeal to a wide audition and also to invest in maybe one or two obscure artists who may not have every bit a commercial appeal but who create very special and unusual pieces.

- I would invest in a more obscure upward and coming artist like Pasquale Cupari. His pieces are very unusual and he mixes many different mediums. I cannot see his paintings being very commercially successful but I think there are buyers who would appreciate and believe in the bizarre pieces he creates

- It is through the exposure of the new upward and coming artists the fund will endorse that will generate the largest profit. If the fund hangs onto all information technology'southward investments, the demand for each creative person will likely increment after much promotion is done.

- I would too donate portions of the funds portfolio to a museum or other public foundation. This would betrayal the fund to a larger audition and make the public more aware of the blazon of works in the fund.

A Living Audio II by Jasmina Danowski. Ink and gesso on paper (60X xl inches).

This painting is a practiced size and I believe it has huge resale value every bit I think it could appeal to many experienced buyers and buyers who are just starting their fine art collections.

Paparina past Pasquale Cupari. Oil, Enamel and mixed media on Sail.

I believe this work is a little more obscure and will take less commercial appeal only will have have resale value to sure buyers.

Links to the very interesting Rembrandt reattributing stories:

http://www.dailymail.co.uk/sciencetech/article-2069176/Old-man-Beard-WAS-painted-Rembrandt-New-10-ray-technique-solves-art-riddle.html

http://www.bnl.gov/bnlweb/pubaf/pr/PR_display.asp?prID=1359

http://www.codart.nl/news/457/

Nicholas Krislov

The Fine art Investment Funds are a double-edged sword. In that location is much show pointing to the fact that these funds do not rise and fall with the disinterestedness market, and further are less prone to volatility. FAF founder, Phillip Hoffman states that a Canaletto will "never fall to goose egg", however highlights the fact that stocks and bonds may autumn to null.

In that location are misconceptions about the caste to which art funds are safer than more mainstream investment funds. It is not the fact that fine art is a real asset that makes the fund safer than conventional products. The underlying art is what makes the fund safer. The deviation betwixt a Canaletto and the starving artist down the street is that the hazard in paying $250,000 is far less for the Canaletto, despite the payoff existence greater. The fund managers know exactly what they are doing. Often the managers have worked previously in finance and private equity. The funds are essentially private equity funds backed past art. The v to ten year horizon is interesting, equally the fund managers tin can pick the absolute most opportune fourth dimension to sell the work. Considering these are airtight funds based on ane of a kind pieces, it is difficult to marker the fund to market, likewise a professional valuation.

What I detect near interesting is the investment strategy of these funds. Horwitz states that there are usually three strategies funds use: diversified, region specific, and distressed avails. Every bit the art investment fund is nonetheless in its infancy, it is clear that many of these funds take a fairly conservative investment arroyo. Very few are focused on small name artists looking to striking the lottery.

If I set an art fund I would telephone call it the NK1 Fund and most probable take a diversified arroyo. I am weary of putting all the capital into art from one geographic area or 1 style of art. In the Tosca Photography Fund 2011, the fund'south head stated, "As seen in these sales, not every loftier ticket item sold, but peradventure that is not a bad matter equally it indicates connoisseurship rather than exemplifying the vortex in which everything that is offered is absorbed by the market". This quote explains that at that place is hazard involved in the investment, however quality fine art collections behave more assurance with the electric current sophisticated collectors.

In my fund I would wait for heavily undervalued contemporary pieces from masters, as well as low value not-even so famous artists. The low value masters would exist used to hedge against risk. I example of this would exist Picasso's Les femmes d'Alger, version L. The painting recently sold for $21 million, well under its $30 million gauge. Using this strategy of property big name pieces, I would besides lend the art work out to galleries and museums for a few percentage points, hoping to further increment the value.

Amid the diversified art pieces, my fund would also invest in new up and coming artists in hopes that over the longer menstruation of time, their fine art would greatly appreciate in value. Finding lists and post-obit the emerging art scene would exist extremely important. Yet, taking a hands on role in choosing work would greatly do good the fund. I would invest in artists similar Colin Roberts, an emeging creative person who works with Plexiglass (shown beneath). He has recieved contempo noteariety, and a abrupt increase in need for his work could mean a neat return.

The main strategy for my fund would be buy and concord (while putting the famous works in galleries). I believe that the minor arbitrage transactions, and buying distressed work carries far more risk.

Tadd Phillips

Unable to render {include} The included folio could not be establish.

Consider & comment:

Please use this space to answer to your classmates' work and to engage in lively discussions on the day's topic. Keep your comments concise and conversational by responding to others, rebutting or supporting their ideas. Use the annotate box beneath for these observations.

Source: https://confluence.cornell.edu/display/tam2011/Photography%2C+Investing+and+Art+Funds?focusedCommentId=168068540

0 Response to "I Dont Want to Spend Money on Appraisal if My Art Is Worthless"

Post a Comment